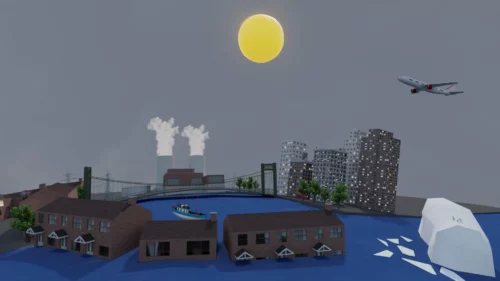

The Earth Day scenes are available until Friday, April 26, 2024 in Avantis Education’s Eduverse platform (go.Eduverse.com)

Latest

-

-

The New Hampshire Department of Education (NHED) is partnering with Discovery Education on a new civics curriculum to support students.

-

Former President of the Science Teachers Association of Texas, Kiki Corry shares insights on how to improve science programs by incorporating exciting phenomena

-

SchoolStatus Launches SchoolStatus Boost, an Innovative Educator Development Solution for...

4 minutes readSchoolStatus, a leader in K-12 data-driven solutions that empower student success, announced the launch of SchoolStatus Boost.

-

Arizona’s Apache Junction Unified School District Announces New Collaboration with...

4 minutes readArizona’s Apache Junction Unified School District (AJUSD) today announced a new collaboration with global edtech leader Discovery Education.

-

KidWind Worlds will have two competitions for students: the World Wind Turbine Challenge and the World Solar Challenge.

-

Sit down with Amy Nakamoto from Discovery Education and Tiffany Kerns from the Country Music Association to learn about STEAM education in action.

-

AERDF announced a major new initiative to improve the future of learning for Black and Latino students and those experiencing poverty.

-

Winning teachers receive a school-wide subscription to the AI Coach platform by Edthena for the 2024-25 school year.

Educators

Amy Nakamoto from Discovery Education sits down with Linn Parrish, Head of Partnerships at Takeda to talk about the connections between health and education.

edTech Business

On the wire

Subscribe

Subscribe and get our trusted educators, administrators, teachers, students, global education influencers, media personalities, authors, well-known thought leaders, social media giants, education change-makers, and strategic education advisors right to your inbox.

Copyright © 2014-2022, edCircuit Media – emPowering the Voices of Education.